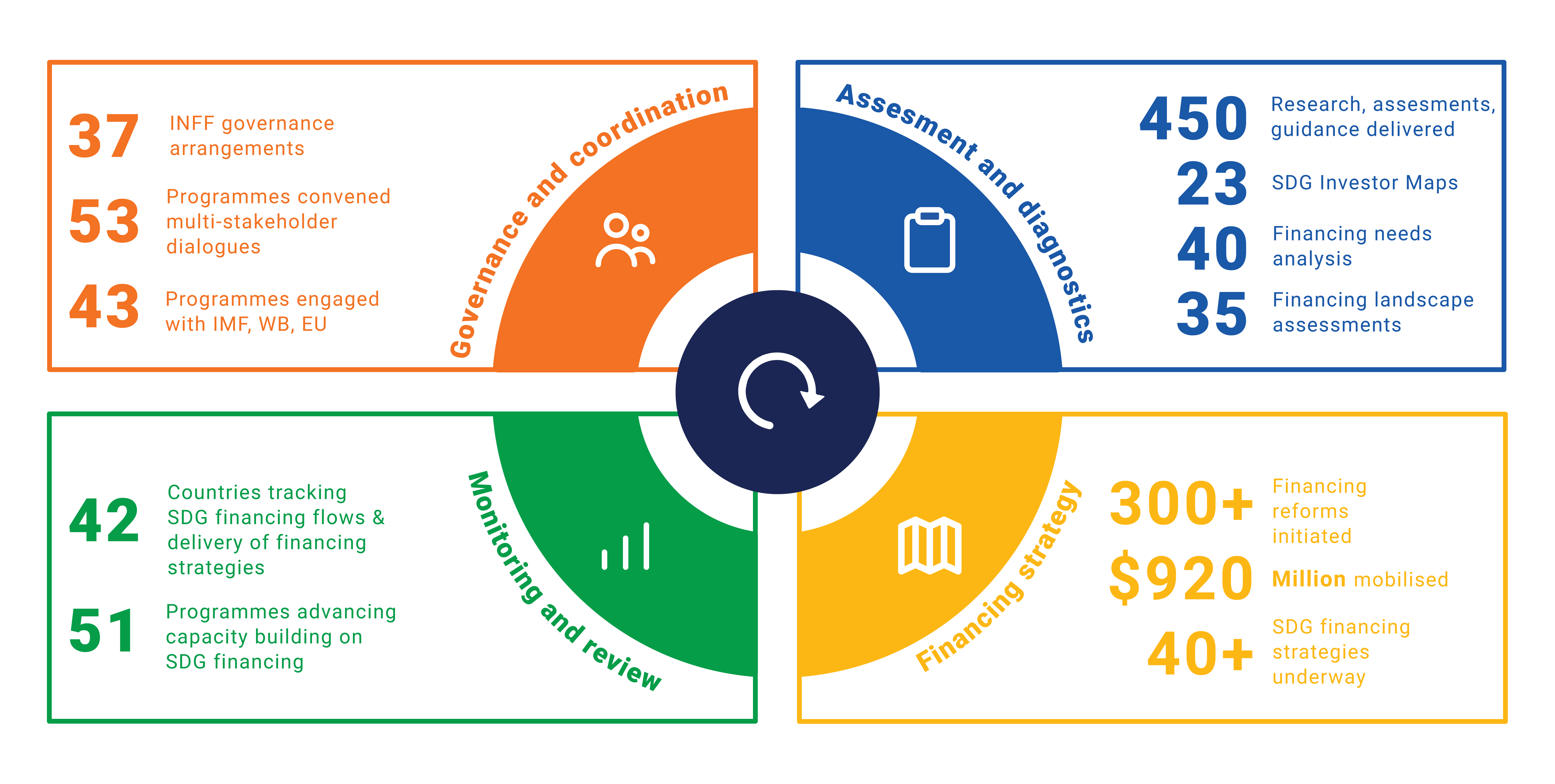

working capital funding gap

Below are key benefits of working capital financing. In the second part you learn how to increase profitability by optimizing.

Working Capital Funding Gap Problem Water Cooler Analystforum

The cash gap is 90 days so the company will have to borrow enough to cover 90 days cost of goods.

. The cost of goods sold for one days revenues is 60 of 200 million or 120 million. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt.

Even if the terms are. Managing the working capital fund gap. Give customers a discount if they pay.

They dont include fixed assets with a life of more than one year eg. Cover Expenditure Gaps Working capital. Working capital is the cash used daily cover all of a corporations.

Relevant liabilities are usually expenses due within 12 months. Automation simplifies this a lot. Funding gaps can be covered by investment from venture capitalor angel investors equity sales or through debt offerings and bank loans.

They include accounts payable. Average working capital Working capital averaged for a period of time Sales revenue Income from sales. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

In the first part you learn how to get out of a short-term financing gap by increasing working capital. We offer a wide variety of products and constantly look to add to our program offerings. After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the.

To get idle funds 1. This financing option is beneficial for different business types and purposes. DWC Average working capital 365 Sales revenue where.

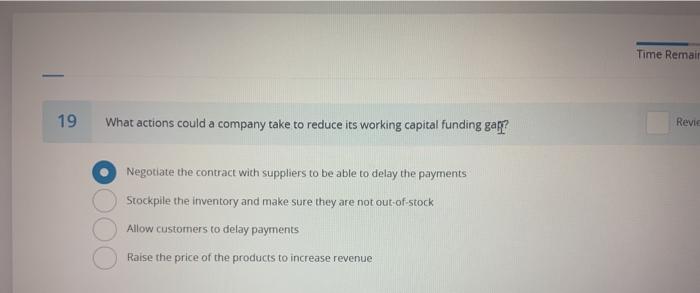

Working Capital is a general term for commercial financing. Delivering new working capital finance models through future technology Advances in technology have permeated every aspect of life. The action Company should take to reduce its working capital funding gap by Increasing inventory levels.

In case if your company has over-utilized its working capital limits and in need of quick funds mortgage finance works it offers flexible repayment of 15 to 20 years also en-cash 80 of the. We recognize that all business owners. Send invoices early so that you can get inflows faster.

Working Capital Financing Beginner S Guide Ondeck

Gap Funding By Diagoro Inc In Roswell Ga Alignable

Working Capital Financing What It Is And How To Get It

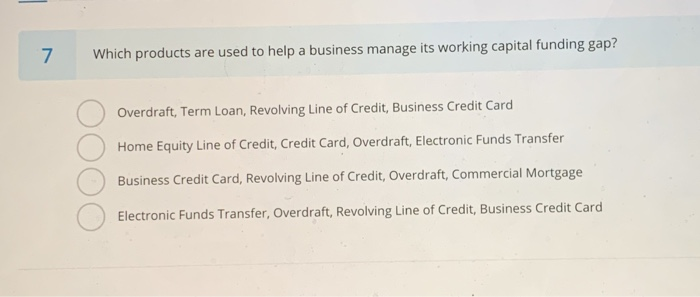

Solved 7 Which Products Are Used To Help A Business Manage Chegg Com

Working Capital Financing What It Is And How To Get It

Working Capital Management Fti Consulting

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Vernimmen Corporate Finance Working Capital Requirement And Financial Debt Where To Draw The Line

Working Capital Financing What It Is And How To Get It

Power Bi Working Capital Funding Gap Youtube

Solved Time Remail 19 What Actions Could A Company Take To Chegg Com

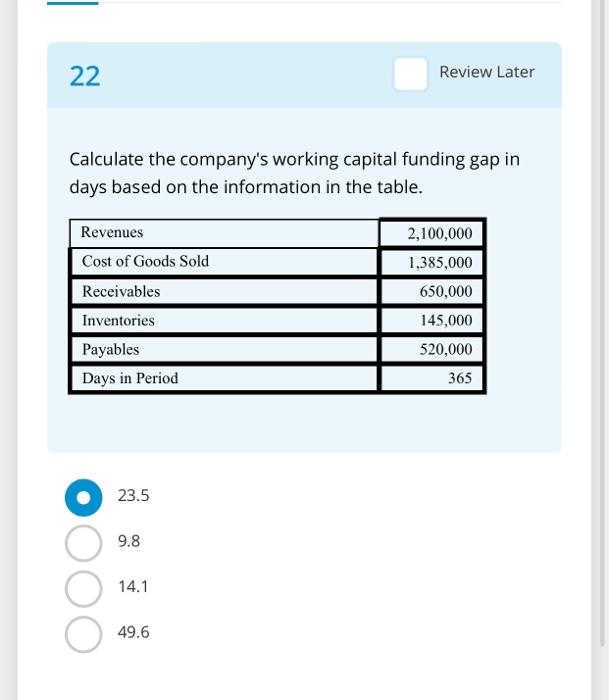

Credit Analyst How We Calculate Working Capital Funding Gap The Wcfg The Period Between Company Pays For Inventory Cash Out And Company S Customers Pays For Goods Cash In طريقة الحساب

Working Capital What Is Working Capital Youtube

Solved Provide The Best Answer For Each Of The Following Chegg Com

5 Reasons To Seek Business Funding Small Business Finance Float

Solved Calculate Accounts Receivable Days Based On The Chegg Com

Charter School Funding In Your State Charter Asset Management